A drawing in accounting terms includes any money that is taken from the business account for personal use. What counts as a drawing?Ī drawing acts similarly to a wage but is applied to sole traders or partners. This is why it’s so important to keep a drawings account, which needs to be closed at the end of the financial year, ensuring that your books aren’t disrupted by this financial transition while also maintaining a clear record of all the moving parts of your business. It is also not treated as a liability, despite involving a withdrawal from the company account, because this is offset against the owner’s liability.

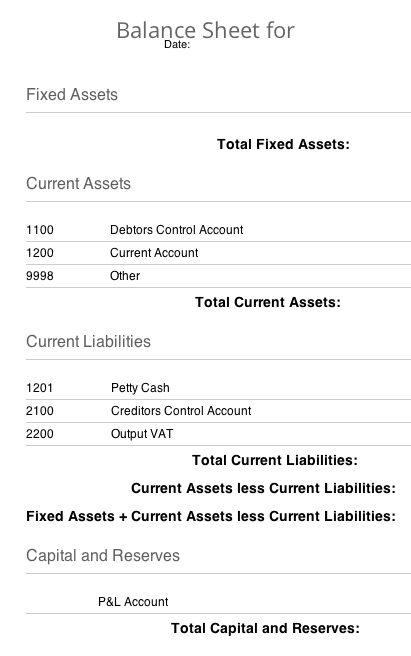

Are drawings assets or expenses?ĭrawings from business accounts may involve the owner taking cash or goods out of the business – but it is not categorised as an ordinary business expense. As a result, the placement of drawings within the balance sheet depends on how it is categorised. A typical balance sheet records your business’s assets and liabilities as well as shareholder equities. The balance sheet is also known as a statement of financial position, and it is an essential document for assessing and demonstrating your business’s economic position. This can be cleared in several different ways, including through repayment by the owner or a reduction in the owner’s salary to compensate for the amount withdrawn. If the withdrawal is of goods or similar, the amount recorded would typically be a cost value.ĭrawings accounts are temporary documents and these need to be balanced at the end of a financial year or period. If the withdrawal is made in cash, this can easily be quantified at the exact amount withdrawn. On your balance sheet, you would typically record an owner withdrawal as a debit. How do you record drawings in accounting? It will also represent a decrease in the owner’s equity as the owner is, essentially, cashing in on a small piece of their entitlement to the company.ĭrawings will also show up on a statement of cash flows as they represent a type of financial activity and so need to be accurately recorded by the company’s account departments. As such, it will impact the company’s financial statement by showing a decrease in the assets equivalent to the amount that is withdrawn. How do drawings affect your financial statements?ĭrawings in accounting terms represent withdrawals taken by the owner.

#ARE EXPENSES LIABILITIES ON A BALANCE SHEET HOW TO#

Having a separate drawing account makes it easier to keep track of these transactions and to balance the books at the end of each financial year, when you need to know how to close your drawings account. It’s essential to keep accurate records of these withdrawals because they need to be offset against the owner’s equity. These are withdrawals made for personal use rather than company use – although they’re treated slightly differently to employee wages. The meaning of drawing in accounts is the record kept by a business owner or accountant that shows how much money has been withdrawn by business owners. A drawing account is not actually a bank account in itself.

0 kommentar(er)

0 kommentar(er)